Giles Free Speech Zone

The purpose of the "Giles Free Speech Zone" is to identify problems of concern to the people of Giles County, to discuss them in a gentlemanly and civil manner, while referring to the facts and giving evidence to back up whatever claims are made, making logical arguments that avoid any use of fallacy, and, hopefully, to come together in agreement, and find a positive solution to the problem at hand. Help make a difference! Email "mcpeters@usit.net" to suggest topics or make private comments.

Contributors

Thursday, June 01, 2006

Wednesday, May 31, 2006

E-mail topic: Gasoline Price Gouging???

Tuesday, May 30, 2006

And now... a look at the revenue side

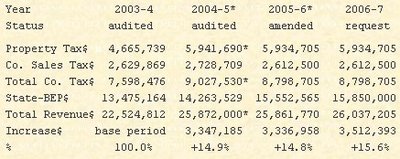

GILES COUNTY SCHOOL SYSTEM

FUND 141 2006-2007 BUDGET - REVENUE

Quote from bottom of page 13, school budget for 2006-7:

"THIS BUDGET WOULD REQUIRE A 63 ½ CENT INCREASE IN PROPERTY TAXES ASSUMING A PENNY BRINGS IN $40,929 (THE SAME AS THE 2005-6 FISCAL YEAR) - EXPENDITURES EXCEED REVENUES BY $2,598,439."

The 2004-5 through 2006-7 data is taken from pages 1 & 2 of the 2006-7 school budgets. The 2003-4 total revenue was $22,524,812, ref page 41, June 30, 2004 Tennessee Audit.

*The 2005-6 budget approved in August, 2005 lists $14,123,431 state BEP & $24,311,631 total school taxes, plus $24,735,058 for 2004-5 totals! There is no measurement or correlation to that budget or reconciliation of expenditures to funds!

DO YOU BELIEVE THE BUDGET?

1. Property taxes are lower in 2005-6 & 2006-7 than in 2004-5!

2. County sales tax is over $100,000 lower in 2005-6 & 2006-7 than 2004-5!

3. 2004-5 State matching funds are up only $788,365 when local county taxes jumped $1,429,054 plus spending increases of $1,343,000.

4. 2005-6 State matching funds are up $1,289,036 with local tax DECREASES of $228,825 and whopping spending increases of $2,944,628 vs. 2004-5!

5. They forgot to add the $2,598,439 to property tax for 2006-7. Total property tax of $8,533,144 is a lot more, not less than last year! IT IS AN 83 % INCREASE IN 3 YEARS SINCE 2003-4!!! Retirees would be lucky to get 3% during that time.

6. State matching funds are up only $297,435, while local taxes leap by more than the $2,598,439, plus spending leaps by $1,946,208 (2006-7 vs. 2005-6)!!!!

7. Incredibly, the tax increase is based on the difference between spending dreams and grossly understated revenue! The books aren't cooked. They're cremated!

What defines bizarre? Winkles & Barrett were jailed on trumped up charges by Gonzales & Jackson because they were sniffing too close to the honey tree. What have the doctors mastered in degrees of knowledge? They have mastered doctoring of the books. We see. We don't see. We have $4.3 million in 2 year spending increases through 2005-6, plus the audacity to make it $6.2 million for 3 years in 2006-7! The revenue game is simply bizarre. It doesn't end here - there is more incredible stuff.

The question is how bizarre things can get. I'll bet bizarre can be defined by those who voted for the last undocumented amendment, beginning with Holt. The doctors of education prescribe more of your money to feed the illness. Common sense prescribes cleaning house, open windows, and letting a little sunshine in by simply voting supporters of this corruption out of office in August. Get mad or go broke!

Don MacDermid

Monday, May 29, 2006

Let's Try This One More Time....

Quote from bottom of page 13, school budget for 2006-7:

“THIS BUDGET WOULD REQUIRE A 63 ½ CENT INCREASE IN PROPERTY TAXES ASSUMING A PENNY BRINGS IN $40,929 (THE SAME AS THE 2005-6 FISCAL YEAR) – EXPENDITURES EXCEED REVENUES BY $2,598,439.”

The 2004-5 through 2006-7 data is taken from page 13 of the 2006-7 school budgets.The 2003-4 comparable grand total expenditures was $22,401,759, ref page 51, June 30, 2004 Tennessee Audit.

Annual Period··2003-4··········2004-5*··········2005-6·········· 2006-7

Spending $······22,401,802···23,744,802*··· 26,689,430··· 28,635,644

Increase $ ·······base period······· 1,343,000 ······4,287,628····· 6,233,842

% ····················100.0%·········· +6.0%·············· +19.1%··········· +27.8%

*Total 2004-5 as stated on 9-30-5 in the 2005-6 budget data was $24,688,220.

1. What does “NO” mean? The paper quoted Jackson as saying, “no increase in years”. The 2006-7 Jackson - Gonzales School Budget clearly shows 2005-6 is $4.3 million more than 2 years ago! That clearly fits the definitions of deceit, lie, false witness, etc.!

2. If that act and representation is designed to mislead for the purpose of gaining advantage, it fits the definition of fraud. If the purpose of that act of deception is to gain money by misrepresentation and deceit, it becomes criminal fraud. Jackson, Gonzales, (and Holt) are fixing to raise property taxes by almost 30% in the same 3 year period where retirees who will be forced to pay it will receive less than 3%!

3. Their budget request increases property taxes by the entire $2,598,439 new spending. Historically, property tax was only 20% of total school funding sources, not all of it. The other 80% came from state matching funds from sales tax and the local county sales tax. If the full $2.6 million was legitimate, funding requirements would be $0.5 million (20%) property tax and $2.1 million (80%) from matching funds & local sales tax.

4. State matching funds appear to be about 2.12 times local taxes. If the full $2.6 million were raised by local property tax and spent for qualified matching fund items, matching funds (from the state sales tax) would automatically allow $5.5 million more revenue & spending than disclosed anywhere within the budget funding request!

5. Add them up, and the funding request becomes $8.1 million, not $2.6. It’s a tidal wave of TAX money itching to be spent and wasted! It isn’t a new game! It’s power. It’s a repeat of their 2004-5 & 2005-6 scam. No tax is free. No citizen is free from taxation. It’s in the price of every thing you do, including sleep. Fraud is not a worthy cause!

6. Jackson (Director), Gonzales (COB), & some Directors of our school system are “professionals”, not a bunch of old timers at a liar’s convention. Will your Commissioner ram the scam down your throat? Our icon of wisdom is being tarnished. You can stop it! Tolerance & perversity are taught by example & leadership … If you want it, take it. Say whatever they want to hear. Bang a hammer on the podium to shut them up! Jail non believers if need be! The price of tolerance is oppression! Copy this & pass it on!

Don MacDermid